28+ Accelerated mortgage payment

The following calculator makes it easy for homeowners to see how quickly they will pay off their house by making additional monthly payments on their loan. In this example choosing accelerated bi-weekly payments instead of monthly payments on a 150000 mortgage would save you.

David Bruce Director Of Accelerated Banking The Kwak Brothers Linkedin

The calculator lets you determine monthly mortgage payments find out how your monthly.

. Mortgage Payment Calculator Super Brokers. You can choose monthly semi monthly bi-weekly weekly accelerated bi weekly. The major difference is how the payments are calculated.

By simply accelerating your payments youll be making the. If you were to bump up that payment to 600 you would save about 2626 in total interest 1703 vs. The most common use of a home equity line of credit is to refinance higher interest debt.

When you set up your mortgage you have the option of choosing a mortgage payment frequency. A term associated with making additional unscheduled payments on a loan at predetermined or random intervals. Regular bi-weekly calculations are.

For example say Jon Snow has a mortgage with monthly payments of 1800. Accelerated payment 1113 Accelerated payments 34400. Accelerated payments offer homeowners an alternative from this predictability by factoring one additional monthly mortgage payment each year.

4329 and have the balance paid off 28 months sooner 20 months vs. By making additional monthly payments you will be able to repay your loan much more quickly. Accelerated payments will be a little higher than the non-accelerated options which is how they are beneficial.

The first step in the mortgage accelerator strategy is to open a home equity line of credit. The amortization schedule can be recast their loan is accelerated payment. Simply enter the original loan.

An accelerated payment refers to the process of speeding up payments or making more frequent payments When payments are made more often on a loan or. Simply add the amount by which you want to accelerate your mortgage to your monthly payment and indicate to your lender that the extra money is applied to your principal mortgage balance.

Redeemable Preference Shares When Preference Shares Be Redeemed

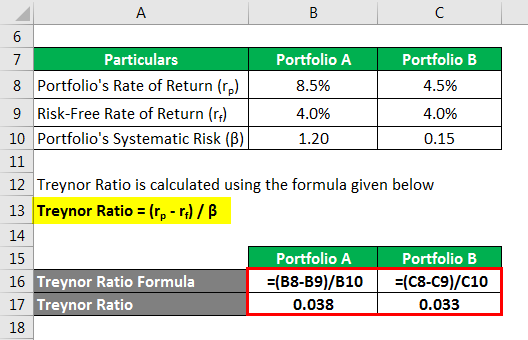

Treynor Ratio Examples And Explanation With Excel Template

Loan Early Payoff Calculator Excel Spreadsheet Extra Etsy Debt Calculator Loan Payoff Student Loans

Why Should You Buy Cars That Are A Couple Of Years Old Instead Of New Cars From A Financial Point Of View Quora

Why Should You Buy Cars That Are A Couple Of Years Old Instead Of New Cars From A Financial Point Of View Quora

Velocity Banking Calculator Demo Spreadsheet Template Banking Spreadsheet

This Is An Email Signature Example For Mortgage Brokers Mortgage Brokers Email Signatures Mortgage

Budget Calculator Budget Planner Mls Mortgage Budget Calculator Budgeting Amortization Schedule

Free Printable Mortgage Commitment Letter Legal Forms Doctors Note Template Legal Forms Letter Form

Currency Exchange Trading Goals Steps For Trading Goals

Pin On Self Defense Pepper Spray

Loan Syndication How Does Loan Syndication Work With Example

Http Vs Https Certificate Authority Online Security Cyber Security

What Should I Be Looking For In Life Insurance Life Insurance Marketing Ideas Life Insurance Facts Life Insurance Marketing

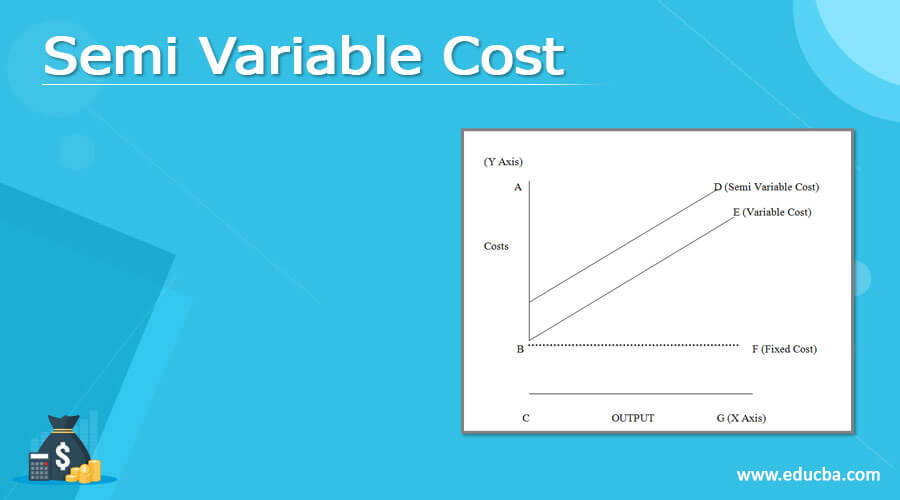

Semi Variable Cost Examples And Graph Of Semi Variable Cost

Job Costing Complete Guide On Job Costing In Detail

Dna Technology Logo Genetic Dna Technology Biology Logo Sponsored Technology Dna Logo Biology Genetic Ad Dna Technology Technology Logo Biology