28+ Taxes Calculator Ohio

Web Ohio State also withholds State Income Tax from the employees paycheck at the progressive rates ranging from 0 to 4797 distributed in eight tax brackets. Ad Access Tax Forms.

2531 Siesta Drive Sarasota Fl 34239 Compass

Ad Lookup State Sales Tax Rates By Zip.

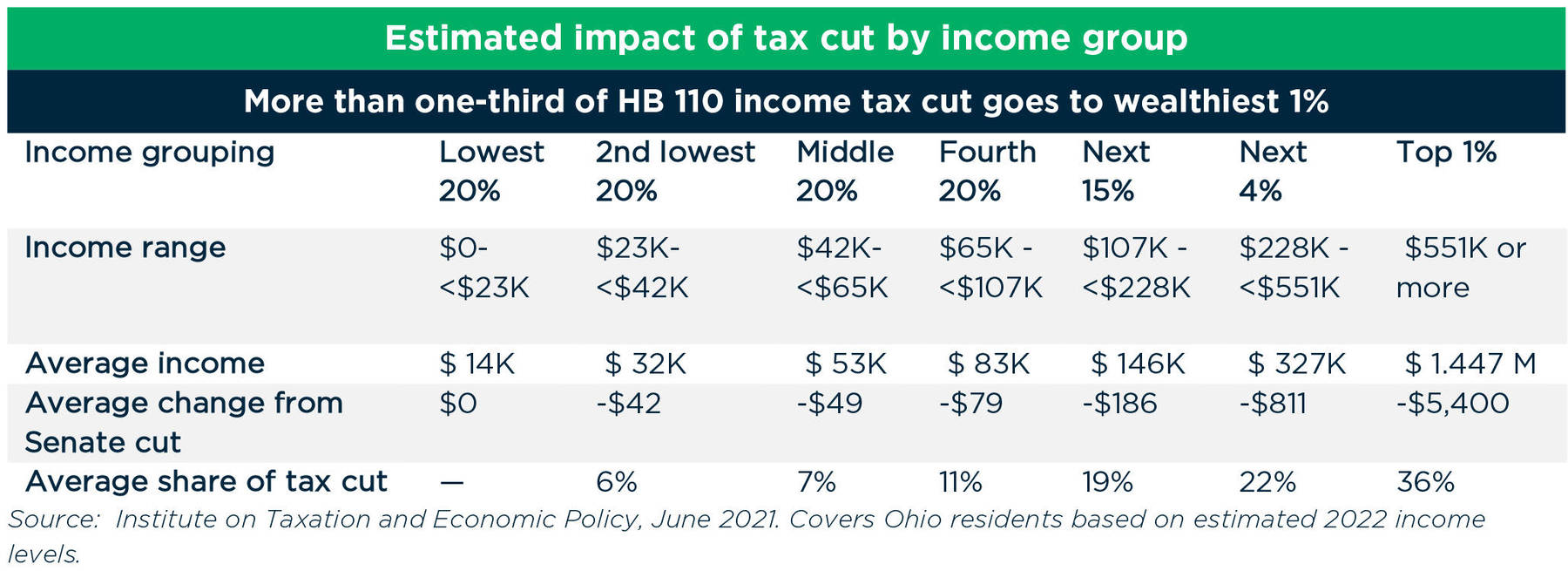

. Web 1st Quarter - April 18 2023. Free for personal use. Web The State of Ohio has eight tax brackets ranging from folks who pay 0 in state taxes to those who pay a total of 8333 plus 4997 of anything made over 217400.

Updated on Sep 19 2023. C1 Select Tax Year. Ad Lookup State Sales Tax Rates By Zip.

Web Estimate Your Federal and Ohio Taxes. Use ADPs Ohio Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Complete Edit or Print Tax Forms Instantly.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Download tax rate tables by state or find rates for individual addresses. Returns due in 2025.

Free tool to calculate your hourly and salary income after. 2765 percent to 399 percent Ohio has four tax brackets ranging from 2765 percent to 399 percent. 4th Quarter - Jan.

The state has five. Ohio state income tax brackets depend on taxable income and residency status. Web Ohio Paycheck Calculator.

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Ohio. Web Income tax. Simply input salary details benefits and deductions and any other.

We Offer an Extensive Selection Of Office Calculators At Great Prices. Register and Subscribe Now to work on your OH Estimated Payments more fillable forms. If you make 70000 a year living in Ohio you will be taxed 9455.

Web Curious to know how much taxes and other deductions will reduce your paycheck. Web The Ohio Salary Calculator updated for 2024 allows you to quickly calculate your take home pay after tax commitments including Ohio State Tax Federal State T. Estimated payments can be made electronically.

Residents of many Ohio cities and villages. Web Ohio Hourly Paycheck Calculator. 2nd Quarter - June 15 2023.

Your average tax rate is 1167 and your marginal tax rate is 22. It automatically calculates taxes based on your employees state of. Use our paycheck tax calculator.

Free Unlimited Searches Try Now. Ad Get Deals and Low Prices On tax calculators At Amazon. You are able to use our Ohio State Tax Calculator to calculate your total tax costs in the tax year 202324.

Web Our Ohio wage calculator estimates workers net income based on their tax rates and withholdings. Rates and Who Pays in 2022-2023. Single Head of Household Married Filing Joint Married Filing Separate.

Web The Ohio Department of Taxation is dedicated to providing quality and responsive service to you our individual and business taxpayers our state and local governments and the tax. Free Unlimited Searches Try Now. Web The state income tax rate in Ohio is progressive and ranges from 0 to 399 while federal income tax rates range from 10 to 37 depending on your.

Download tax rate tables by state or find rates for individual addresses. Web The total taxes deducted for a single filer are 81846 monthly or 37775 bi-weekly. Web Use Ohio Paycheck Calculator to estimate net or take home pay for salaried employees.

Web Ohio Salary Tax Calculator for the Tax Year 202324. Web 2023 Tax Year Calculator. 3rd Quarter - Sept.

C2 Select Your Filing Status. Just enter the wages tax. Simply enter their federal and state W-4.

Ohio Income Tax Calculator Smartasset

Printable Ohio Sales Tax Chart Fill And Sign Printable Template Online

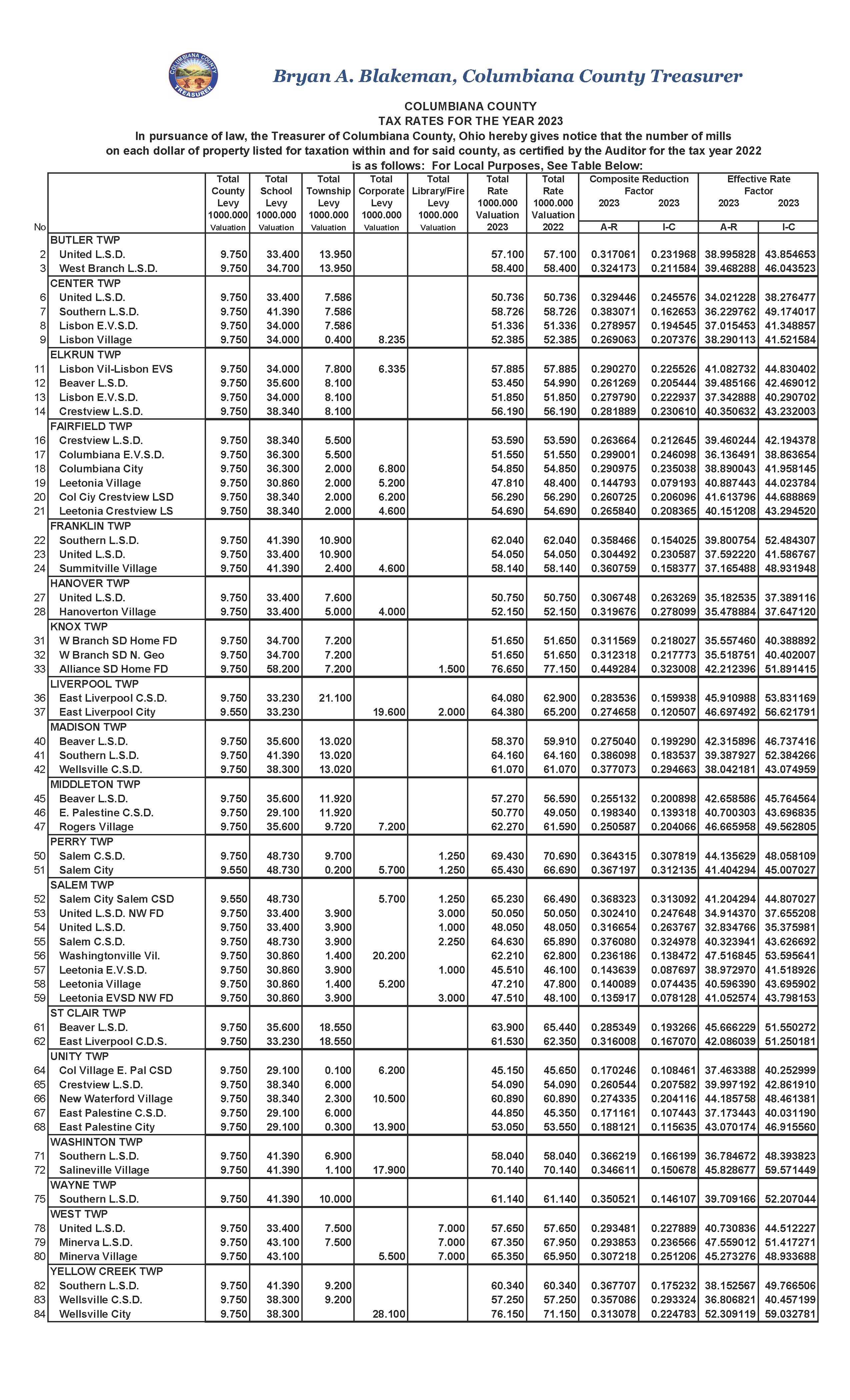

Tax Rates

Ohio Tax Rate H R Block

Ex 99 1

Ohio Paycheck Calculator Smartasset

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Texas Tax Calculator

Used Cars For Sale In Kent Wa Cars Com

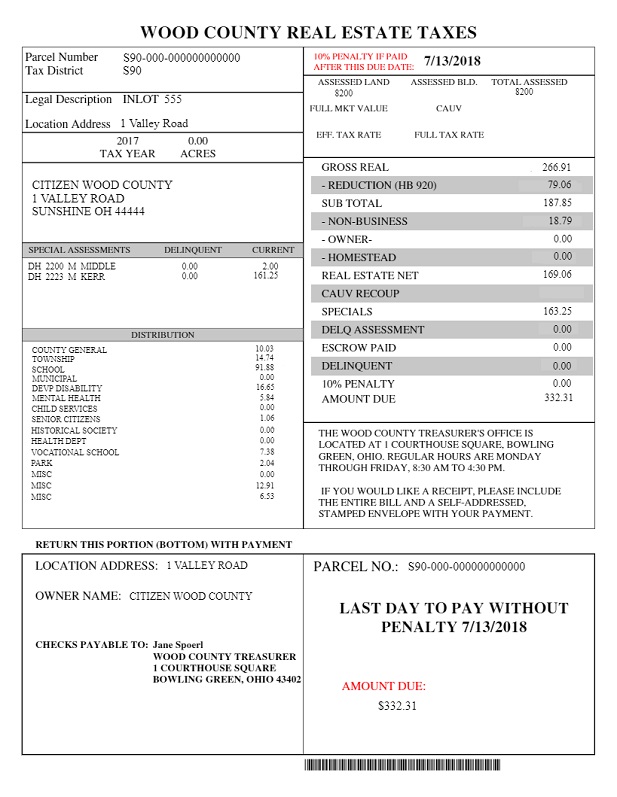

Your Tax Bill Explained

Pdf Bruk Av Tobakk Rusmidler Og Vanedannende Legemidler I Norge Hovedfunn Fra Sirus Befolkningsundersokelse I 2012

College Planning Guide Pdf Marian Catholic High School

Ohio Hourly Paycheck Calculator Oh 2023 Tax Rates Gusto

Smart Erp Solutions Oracle Cloud Services Overview 2021 2022 Ppt

Is 6 Years Of Bookkeeping Worth 28 33 An Hour R Accounting

Spotrac Research News Reports

1505 E Cherry Street Plant City Fl 33563 Mls T3466121 Flmfr