Estimated payroll tax calculator

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. The average one-way commute in Fawn Creek takes 210 minutes.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What does eSmart Paychecks FREE Payroll Calculator do.

. Salary Paycheck and Payroll Calculator. The typical American commute has been getting longer each year since 2010. The state tax year is also 12 months but it differs from state to state.

Everything You Need For Your Business All In One Place. Use your estimate to change your tax withholding amount on Form W-4. To change your tax withholding amount.

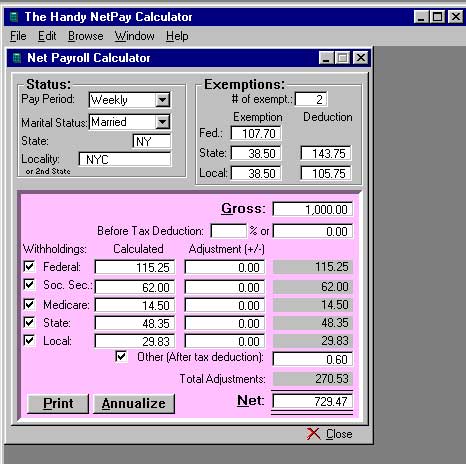

Federal Salary Paycheck Calculator. The calculator can help estimate Federal State Medicare and Social Security tax withholdings. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

Content updated daily for how to calculate payroll taxes. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. All Services Backed by Tax Guarantee.

Calculating paychecks and need some help. Free salary hourly and more paycheck calculators. Skip To The Main Content.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or. Ad Payroll Done For You. Ad Compare This Years Top 5 Free Payroll Software.

Ad Looking for how to calculate payroll taxes. Pay employees by salary monthly weekly hourly rate commission tips and more. Our Premium Calculator Includes.

Some states follow the federal tax. Get an accurate picture of the employees gross pay. The Best Online Payroll Tool.

The Best Online Payroll Tool. Ad Payroll Done For You. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into.

Free Unbiased Reviews Top Picks. Use our free calculator tool below to help get a rough estimate of your employer payroll taxes. The standard FUTA tax rate is 6 so your max.

After You Use the Estimator. Ad Calculate tax print check W2 W3 940 941. Or keep the same amount.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Start free trial with no obligation today. Thats shorter than the US average of 264.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Everything You Need For Your Business All In One Place. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your. SurePayrolls free payroll tax calculator helps small business owners easily calculate payroll taxes for DIY payroll.

Free Unbiased Reviews Top Picks. Ad Compare This Years Top 5 Free Payroll Software. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Federal Withholding Tax Youtube

En Todo El Mundo Emparedado Arpon Salary Calculator Florida Conjuncion Esceptico Toda La Vida

How To Calculate Payroll Taxes Methods Examples More

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Payroll Tax Calculator For Employers Gusto

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Enerpize The Ultimate Cheat Sheet On Payroll

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

W 2 1099 Filer Software Net Pr Calculator

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube